|

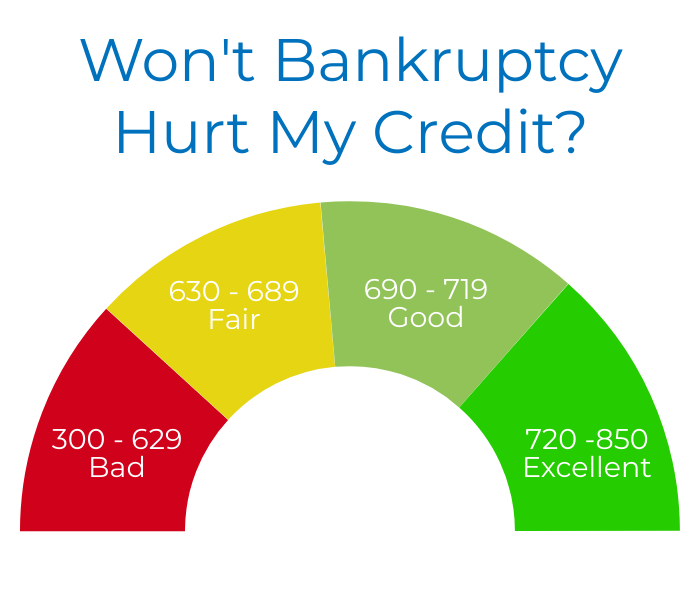

I want to talk about bankruptcy and your credit scores. You already have a financial problem if you are reading this blog. That means your credit score is probably already pretty low. Or, maybe you have been really good at juggling your credit card payments but time is running out and sooner or later, you know you won’t be able to pay them all. Your credit score may be good now, but it won’t last. Frankly, your credit score is the least of your worries if you need to file bankruptcy. You need to be thinking about your rent or mortgage, your car payments, your job, and your family and that lawsuit you might be facing. Those things are much more important than your credit score.

Bankruptcy may hurt your credit score, but it may also save your life. It may free you to live without fear again and allow you to start over with a new life and no financial stress.

Please call me at (805) 446-6262 and we will talk about how to deal with your credit score in a way that helps you the most.

0 Comments

I want to talk about what you can do if your business is failing. You actually have a number of choices when your business begins to fail. You can cut costs. You can lay off employees. You can cut down on advertising or increase advertising. You can offer discounts to the public to bring in new business. Those may or may not be good ideas, but what happens when none of those things work? What happens if your business is shut down, like during the coronavirus pandemic? What happens when you reopen but can’t catch up on the past due bills? And, what happens if you, the owner, are personally liable for those bills?

Hello, my name is Vernon L. Ellicott, and I am a bankruptcy attorney. I help clients in times of personal legal crisis, like when they can’t pay their bills. Today, I want to talk about how bankruptcy can save your life. I just heard of a man who lost his job and then committed suicide. He couldn’t pay his bills and couldn’t face his family. What a shame! And bankruptcy could have saved him!

Yes, bankruptcy may save your life. It may free you to live without fear again and allow you to start over with a new life no financial stress. It may take away the financial tension in your marriage. It may free you to breathe without that pain in your chest because of mounting bills you can’t pay. It may take away the reason for that anger and frustration that makes bad choices even worse.

Please call me at (805) 446-6262 and let’s talk about how bankruptcy can save your life. This blog is about what you can do if your mortgage or rent payments are behind. The reality is that landlords and banks rarely want to evict or foreclose. They will frequently allow you to get several months behind before they take any action against you. But, sooner or later, you either pay or move.

So, what can you do? You can fight, which is usually a losing process and only delays eviction. You can move, but you will still owe the back rent and maybe the mortgage. Or, you can file bankruptcy. Once you move, a Chapter 7 will discharge, a fancy word for get rid of, your back rent. However, for most people, a Chapter 13 is better option. It allows you to get back on your feet financially and to repay the back rent or mortgage over a five-year period. And you can’t be kicked out while you do this. Most people who are behind on their rent or mortgage are also behind on other bills, like credit cards or taxes. Bankruptcy can help with those things, too. Please call me at (805) 446-6262 and we will talk about how to keep you in your house.

I want to talk about bankruptcy and when you should file for bankruptcy.

Most people really do not know their financial situation. They have not made a budget or added up their credit card debt. When they do, they are surprised. So how do you know if you can actually pay off your credit card debt, or if you should file bankruptcy to get rid of the credit card debt? I have used a simple formula through the years to determine whether someone should file for bankruptcy or not. Here it is: If your total credit card debt is 25% of your total annual income, you are in major financial trouble. You may be able to pay off the credit card debt if you incur no more debt and really buckle down on your expenses.

I will be happy to personally walk through an analysis of whether you have too much debt and need to file bankruptcy. Call me at (805) 446-6262 and we can talk about whether you need to file for bankruptcy or not.

|

Vern L. Ellicott

Vernon Ellicott has been practicing law for over 25 years and is admitted to the California and Texas State Bars. He is a Certified Family Law Specialist Categories

All

Archives

�

|

|

Certified Family Law Specialist*

(*State Bar of California), Also Licensed in Texas. We are a debt relief agency. We help people file for Bankruptcy relief under the United States Bankruptcy Code. |

Important Links |

Contact Us

|

Copyright © 2023 The Law Office of Vernon L. Ellicott. All Rights Reserved

Areas we serve: California, Texas

Website designed by MJWebmanagement

RSS Feed

RSS Feed